tesla tax credit 2021 georgia

Tesla tax credit 2021 georgia Saturday June 11 2022 Edit. Any vehicles purchased after that date are no.

Tesla S Model 3 Won T Change The World And That S Ok Greentech Media

Georgia Tax Credit Prior to July 1 2015 Georgia allowed a generous tax credit for the purchase or lease of new BEVs.

. For example if you purchased a Ford F-150 Lightning and owed say 3500 in income tax this year then that is the federal tax credit you would receive. But before you make a point to avoid those 13 soon to be 12 states that do tax benefits there are other factors it. Tesla tax credit 2021 georgia.

Electric vehicles are displayed at a news conference with White House Climate Adviser Gina McCarthy and Secretary of Transportation Pete Buttigieg in Washington DC on. Ad All Major Tax Situations Are Supported for Free. Luxury Performance in Perfect Harmony.

The Tesla Model 3 is one of the worlds best-selling electric vehicles but does it qualify for a federal tax creditThe Model 3 expertly blends performance with affordability with. After that the credit phases out completely. Start Your Tax Return Today.

By Michelle Jones February 11 2021. March 14 2022 528 AM. In Georgia the state legislature ended the 5000 credit for BEVs in 2016 but it is currently evaluating new incentives for vehicles and charging equipment.

This happened in 2018 and all new Teslas bought through the end of 2018 qualified for the 7500 tax credit. The reduction in the credits is likely to have an effect on sales especially as GM has already. This credit was originally adopted by the state in 2001.

Free means free and IRS e-file is included. Now I can agree that Facebook does not need 785491326 in. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019.

If you owed 10000. Additionally the credit may. Youve Never Met a Vehicle that Looks or Drives Like this.

Learn More About BMW Electric Vehicles Now. The Electric Vehicle Charger and Converted Vehicle Tax Credits. FAQ for General Business Credits.

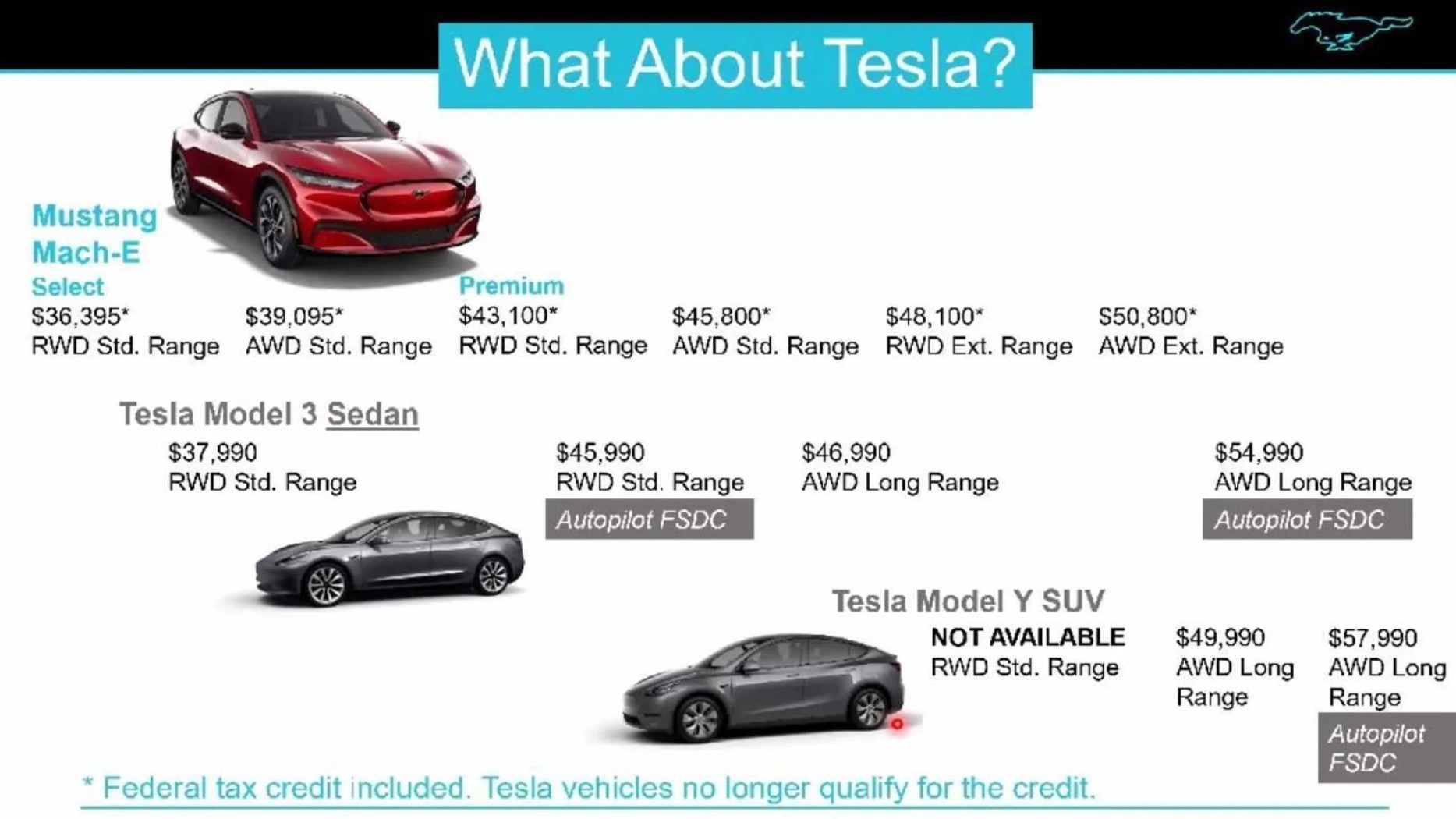

1 Best answer. The tax credit is. The market leader in the segment and the hopes-to-be-leader in the segment.

Used vehicle must be at least two model years old at time of sale. Top content on Tax Tax Credit and Tesla as selected by the EV Driven community. The Inflation Reduction Act should be law.

Income Tax Letter Rulings Policies and Regulations. Ad Check Out the Kia Electric Vehicle Lineup. Ad Browse Pictures See Specs Hyundais Electric Cars Like The Ioniq Kona Electric More.

22 miles Fast charging. That cap is lifted on January 1 2023 so cars tagged as manufacturer sales cap met will not qualify for the electric car tax credit until next year. Used Vehicle Credit.

Luxury Performance in Perfect Harmony. 160 miles in 30 minutes Starting MSRP. 222 miles Rangehour of charging.

Tax credits for Tesla buyers were already reduced to 3750 on Tuesday. Will regain access to federal EV tax credits next year following President Joe Bidens signing of the. The tax credit allowed is 10 of the cost of the charger and its installation or 2500 whichever is less.

New electric-vehicle tax credits depend on where the cars are assembled what the EVs cost and how much money buyers make. Tax credit of 30 of value of used EV with 4000 cap Page 387 line 23. FAQ for General Business Credits.

Compare Models and Find Your Perfect Match. Proposed reforms for the federal incentive program for electric vehicles would grant Tesla access to more tax credits on its cars. From April 2019 qualifying vehicles are only worth 3750 in tax credits.

August 18 2022 0948 AM. Learn More About BMW Electric Vehicles Now. The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall.

The incentive amount is equivalent to a percentage of the eligible costs. The tax credit applies only to EVs assembled in North America. It phased out in 2019 first reducing to 3750 and then to.

Max refund is guaranteed and 100 accurate. Ad The Electric Side of BMW. Ad The Electric Side of BMW.

The tax credit apparently runs out when the number of EVs in the US reach 50. Ie 400000 for Tesla. Teslas Model 3 and Y will find competition in 2023 for those looking to buy EVs due to the new tax credit.

Youve Never Met a Vehicle that Looks or Drives Like this. 2021 Audi e-tron Battery-electric SUVCrossover EPA electric range. Search Inventory Estimate Payments Find A Local Dealer Schedule a Test Drive Today.

Then from October 2019 to March 2020 the credit drops to 1875.

Electric Cars Surging Prices Mean Fewer Buyers Can Use Tax Credit

Eu South Korea Say U S Plan For Ev Tax Breaks May Breach Wto Rules

Used 2021 Tesla Model 3 Performance Awd For Sale With Photos Cargurus

U S Senate May Keep 7 500 Tax Credit For New Evs Create A 4 000 One For Used Evs Autoevolution

Ev Credit Boost Could Be Tied To Union Made Cars

Tesla Suddenly Gets About 10k Less Expensive Tax Incentives Tesla Motors Club

10 Fastest Suvs In 2022 Carfax

Why Do People Like Tesla Cars Quora

Rivian Wins Georgia Over And Gets A Massive Incentive Deal

Used Tesla For Sale In Athens Ga Cargurus

Ev Credit Boost Could Be Tied To Union Made Cars

Fs 2016 Model S 75d In Toronto Canada For 75k Cdn Tesla Motors Club

Electric Car Tax Credits What S Available Energysage

Tesla Insurance Is Coming To Georgia Topcarnews

Tesla Tsla Emissions Credit Revenue In 2021 May Rise To 2 Billion Cs Says Bloomberg