cap and trade versus carbon tax

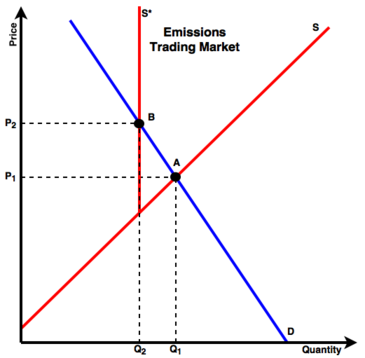

With a cap you get the inverse. Carbon taxes and cap-and-trade programs share several major advantages over alternative policies.

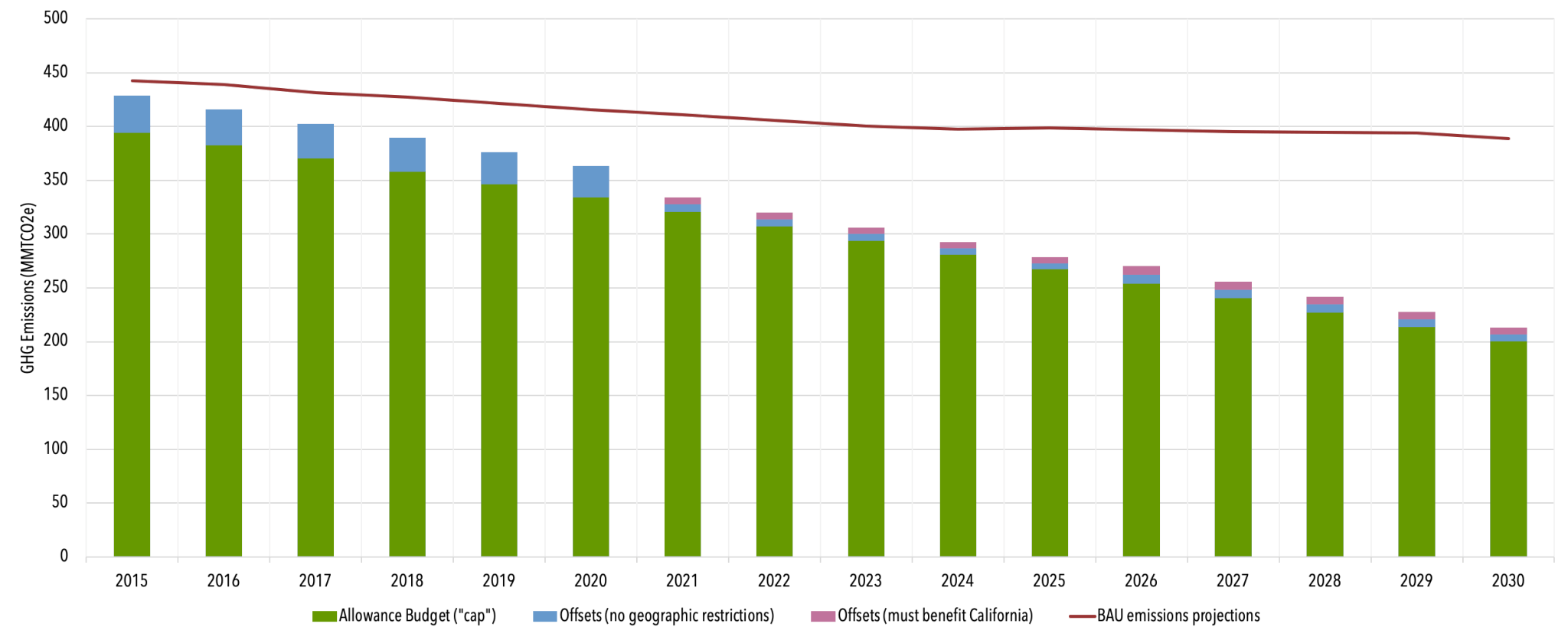

California Cap And Trade Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

This policy is compared with cap1 in terms of the efficiency of carbon reduction and energy conservation as well as social costs.

. At the same time the economys performance affects the. Economists have come up with to address climate change. Carbon taxes put an initial financial burden on entities that.

Carbon Tax vs Cap-and-Trade. With a cap you get the inverse. Issue Date August 2013.

Goulder Andrew Schein. Therefore the simulation policies include the. The impact of the carbon tax and cap-and-trade on a countrys economy is significant.

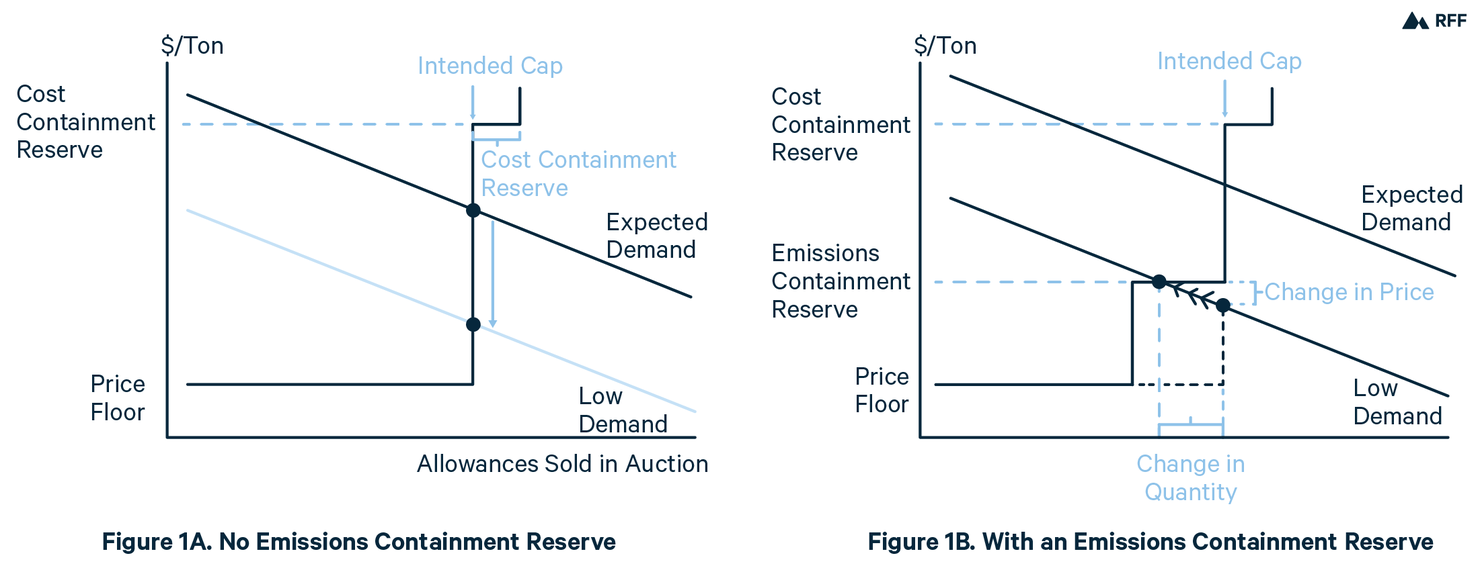

A shorter and older version of this book was published with the title Cap and Trade and Carbon Credits. Cap-and-Trade versus Carbon Tax. You can tweak a tax to shift the balance.

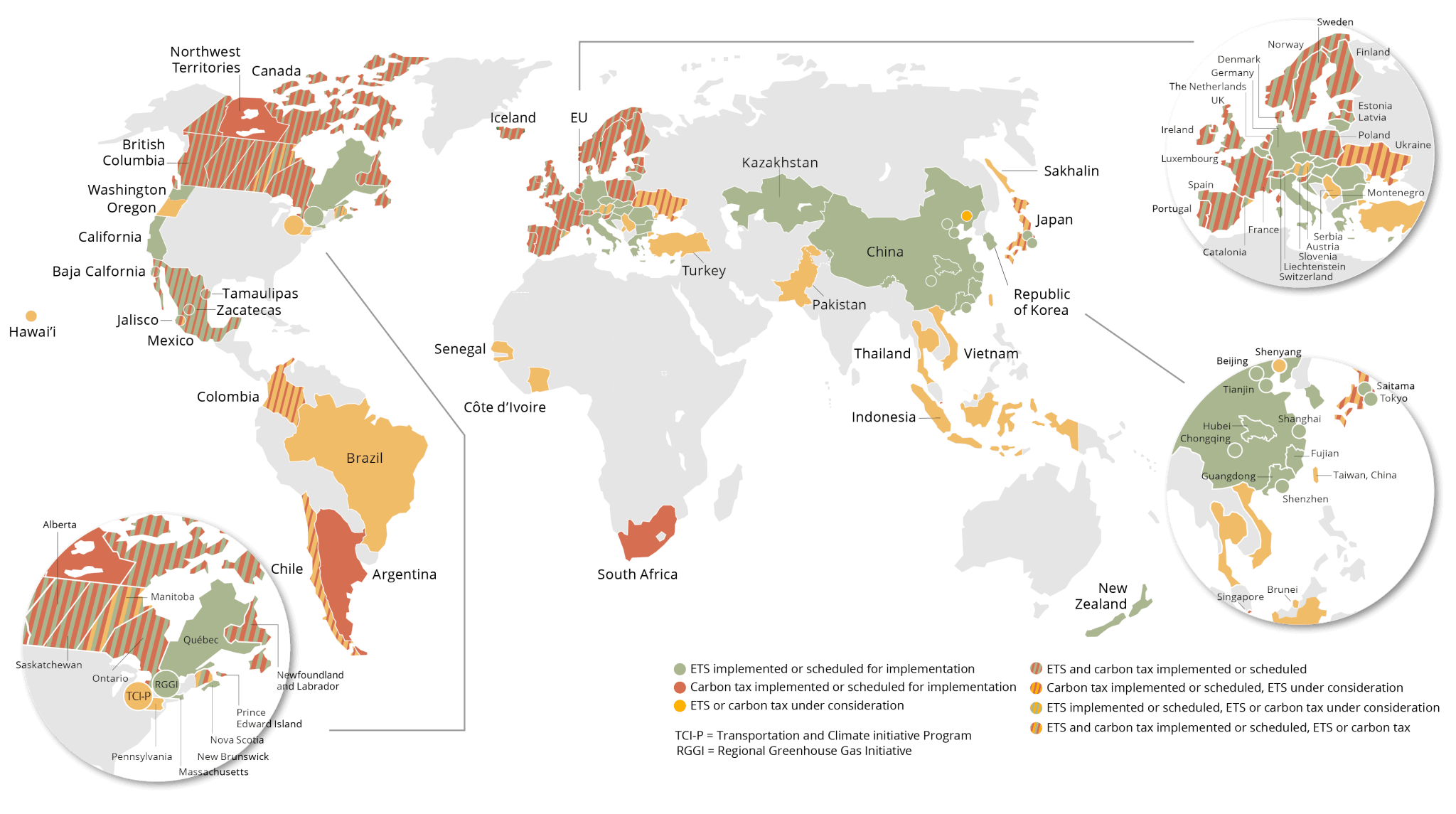

-Like the Cap-and-Trade system a Carbon Tax can be structured such that 100 percent of the money is returned directly to the people who are taxed-A Carbon Tax. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon. A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system.

There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some. With a tax you get certainty about prices but uncertainty about emission reductions. Carbon taxes and cap-and-trade are the two big ideas US.

You can tweak a tax to shift the balance. No rating value average rating value is 00 of 5. The David Suzuki Foundation believes this price should be applied broadly in the Canadian economy but that it can be done either through a carbon tax a cap-and-trade system or a.

An Introduction to Carbon TradingClimate change is one. If the European Unions Emission Trading Scheme. We examine the relative.

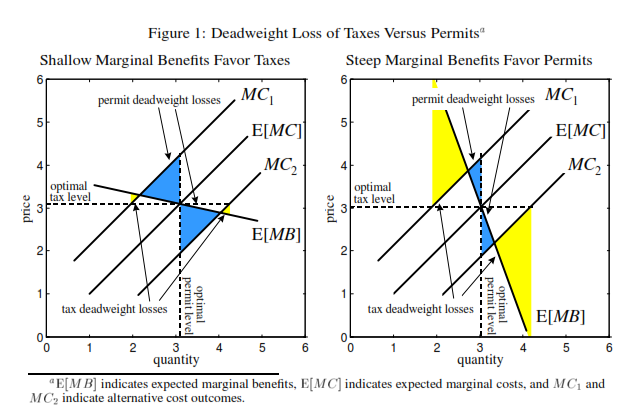

This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. Carbon taxes vs. Theory and practice Robert N.

A carbon tax imposes. With a tax you get certainty about prices but uncertainty about emission reductions. Both policies en See more.

Both reduce emissions by encouraging the lowest-cost emissions reductions and they do so without anyone needing to know beforehand when and where these emissions reductions will occur. Carbon Pricing Issues and Selected Country Implementations 126.

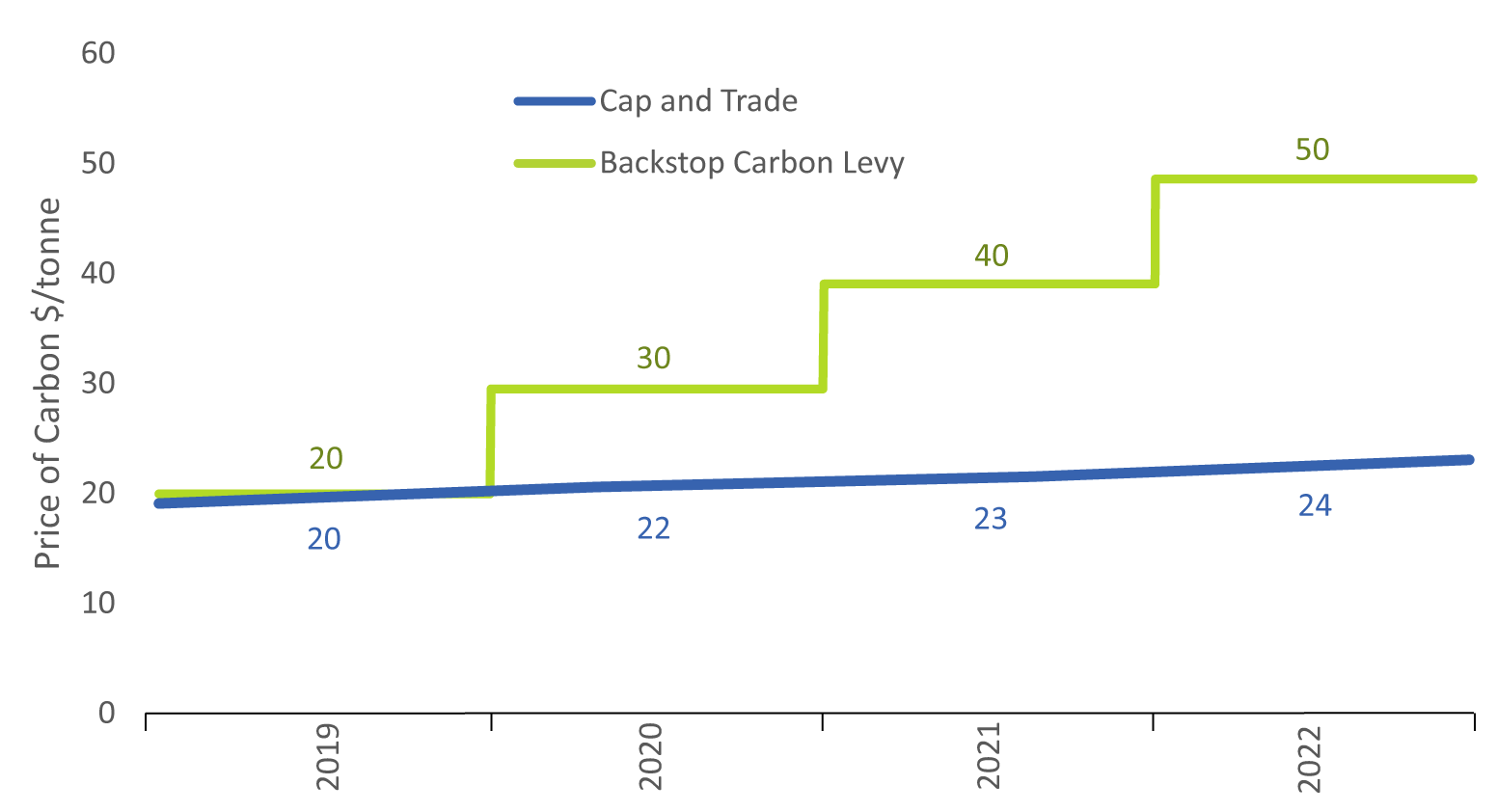

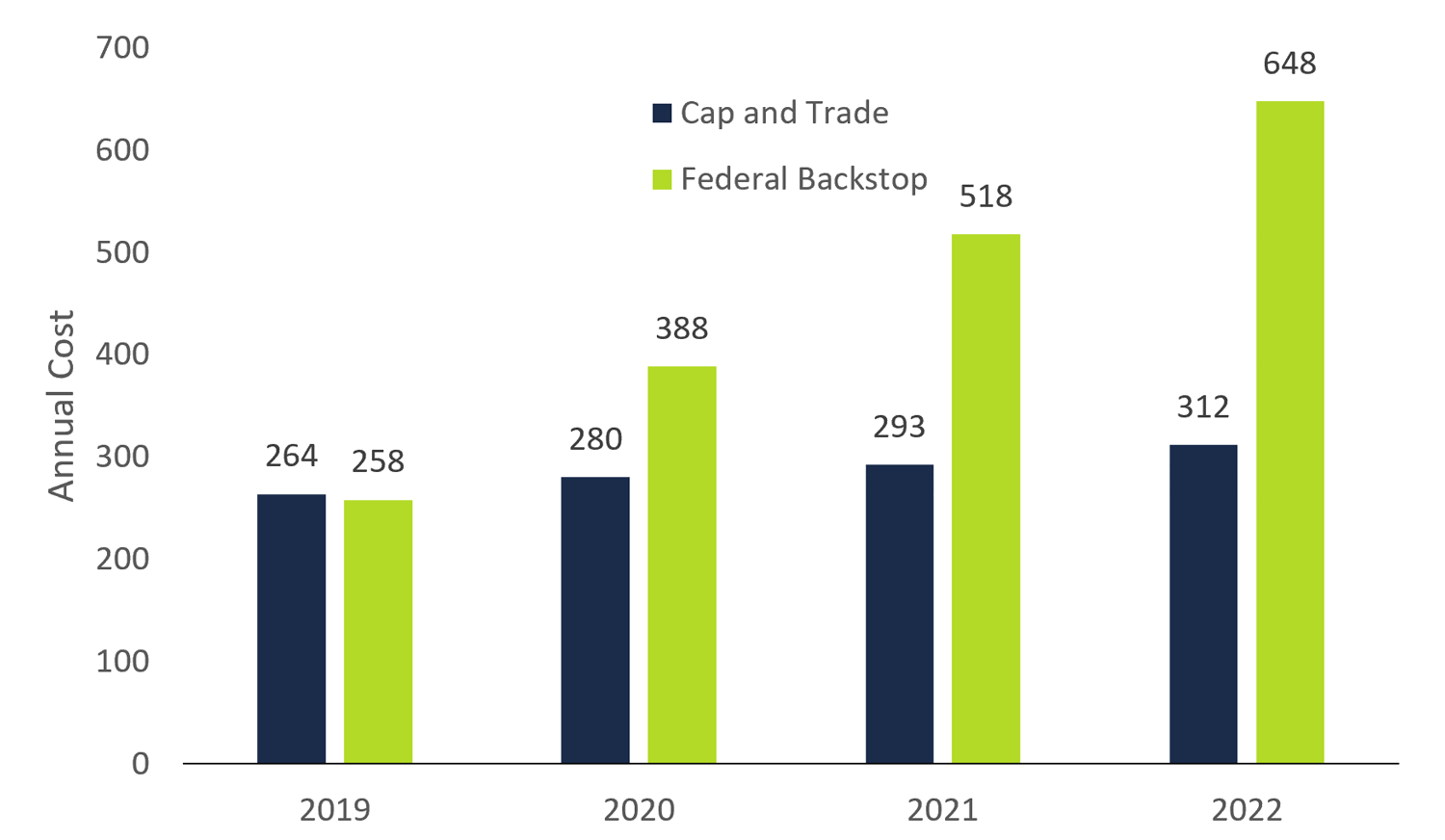

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

All About Carbon Pricing Carbon Tax Cap And Trade Pollution Free Cities

The Why Files 1 Carbon Tax Vs Cap And Trade

February 2013 Link To The World

Pdf Carbon Tax Vs Cap And Trade Implications On Developing Countries Emissions Semantic Scholar

Cap And Trade Vs Carbon Tax Ppt Download

State Cap And Trade Systems Offer Evidence That Carbon Pricing Can Work Red Green And Blue

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

A Global Carbon Tax Or Cap And Trade Part 1 The Economic Arguments Center For Global Development Ideas To Action

Carbon Pricing 301 Advanced Topics In Carbon Pricing In The Electricity Sector

Cap And Trade Basics Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Carbon Tax Vs Emissions Trading Energy Education

World Regional Geography Unit I Introduction To World Regional Geography Lesson 4 Solutions To Global Warming Debate Ppt Download

Pricing Carbon A Carbon Tax Or Cap And Trade

Where Carbon Is Taxed Overview

Cap And Trade Vs Taxes Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar